How To Claim Medicare Levy Exemption

How To Claim Medicare Levy Exemption

Its only if we're charging Medicare levy, your client would need the exemption certificate. When completing the return, they advise if they're a resident for tax purposes. If they're unsure, our residency tool can assist them. An Australian resident for tax purposes is entitled to $18200 tax free threshold.

Medicare Levy Exemption Form Fill Out and Sign Printable PDF Template signNow

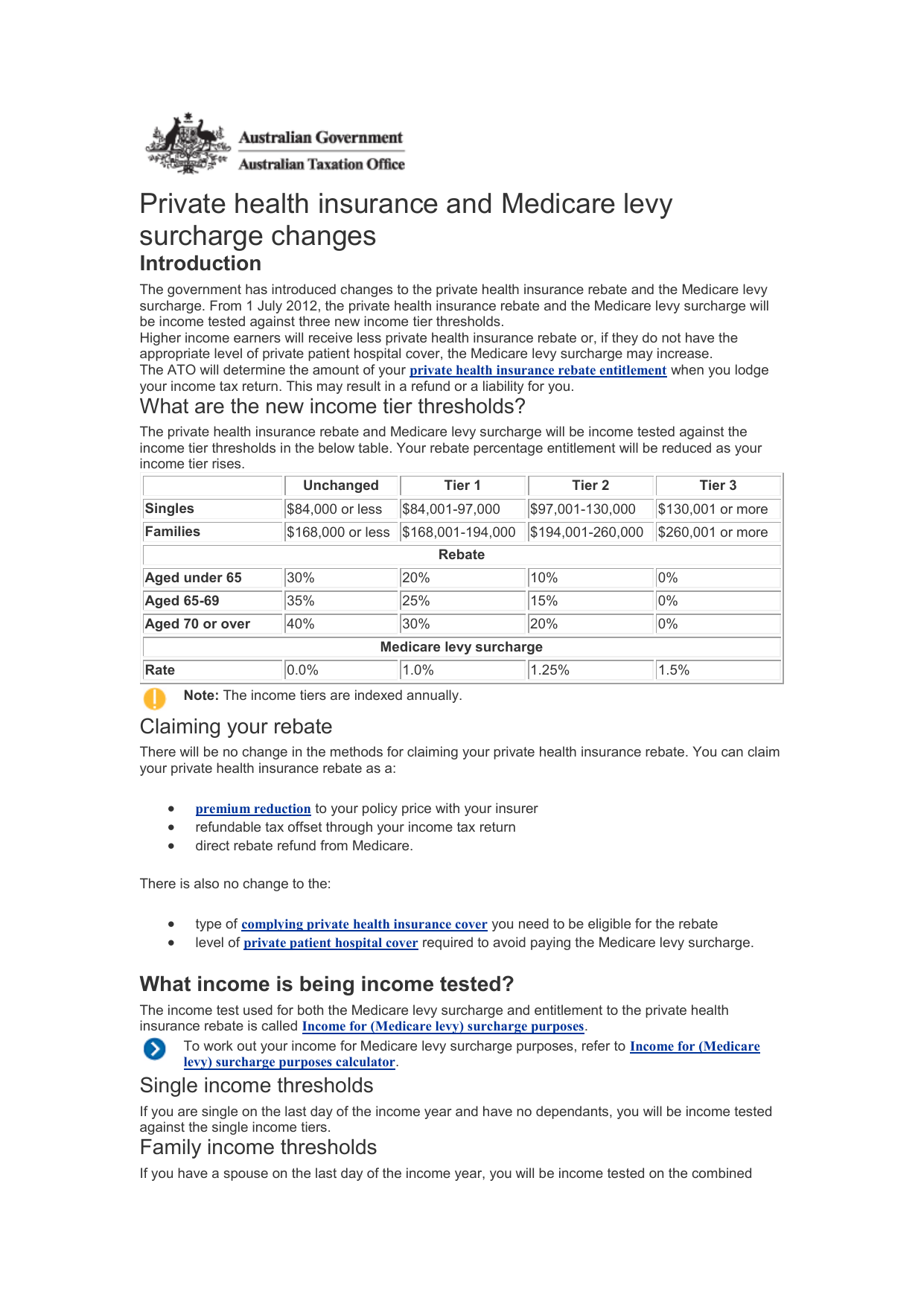

Ekh1 (Newbie) 14 Oct 2023 Needing a bit of guidance on the Medicare levy surcharge, from what I can see if you are single with no dependents and earn less than $90,000 in the financial year you should not have to pay it.

호주 텍스리턴/ 메디케어 레비 면제 신청 Medicare levy exemption 네이버 블로그

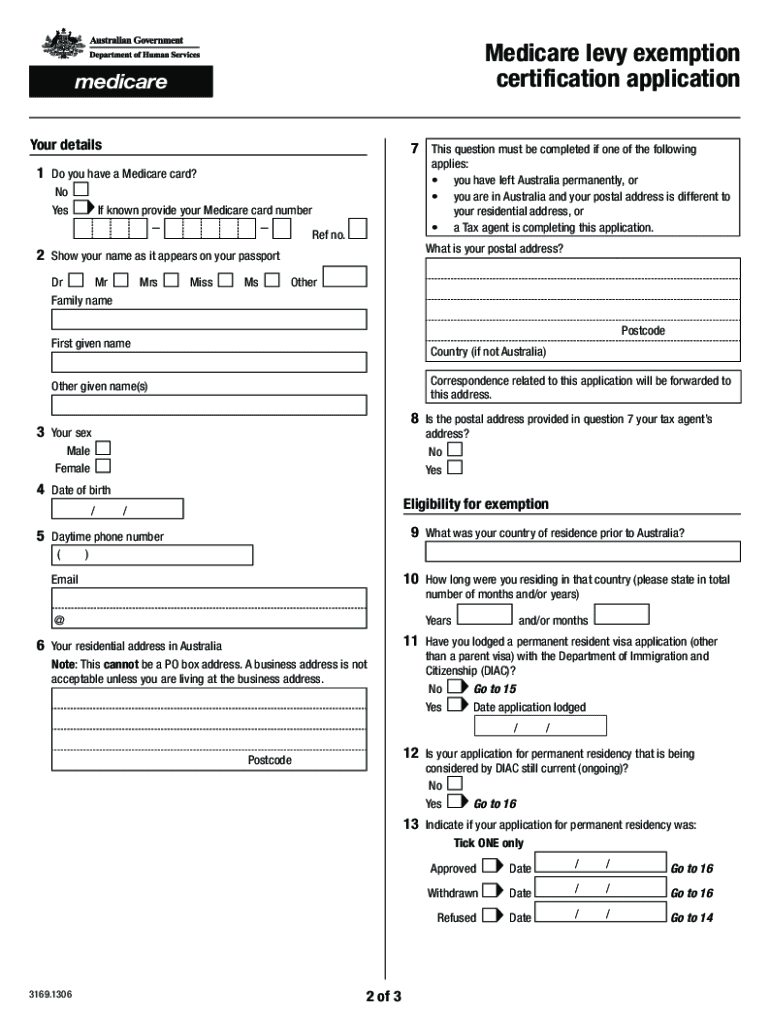

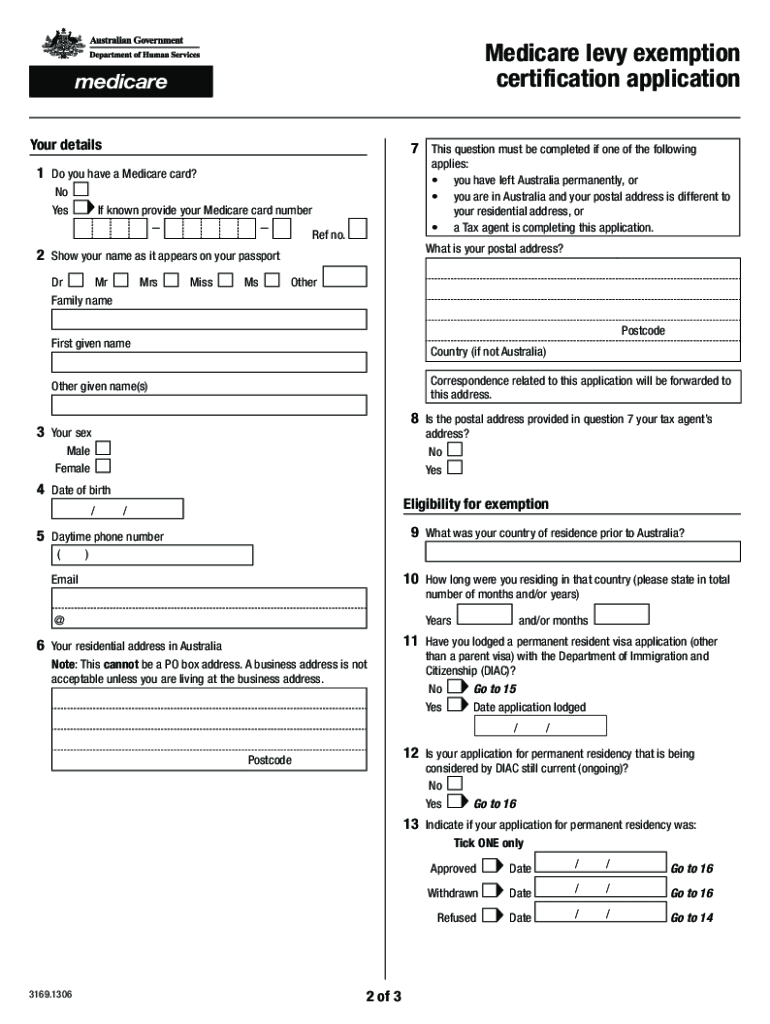

Use this form if you're claiming an exemption from the Medicare levy and need a statement showing you're not eligible for Medicare. The fastest and easiest way to apply for a statement is online using the Individual Healthcare Identifiers (IHI) service through myGov. If you can't apply online through the IHI service, download and complete the form.

medicare levy variation declaration form

6.3.2 Clearing agent/ Importer shall present PVoC exemption certificate or Waiver letter or Diamond Mark of Quality Permit and registered customs entry amongst other import documents to INS-O at the exemptions handling desk established at the port of entry for verification. 6.3.3 INS-O shall carry out document verification.

Medicare Levy Exemption 20132023 Form Fill Out and Sign Printable PDF Template signNow

Riley Fox, you have to check in and show your lab report at the airport in order to get a boarding pass. This was in both directions. Upon landing in Milan, the border agent asked for passport and lab report. Report inappropriate content. 6. Re: Disclosure and Attestation for return to the USA.

Medicare Levy Surcharge 2021 YouTube

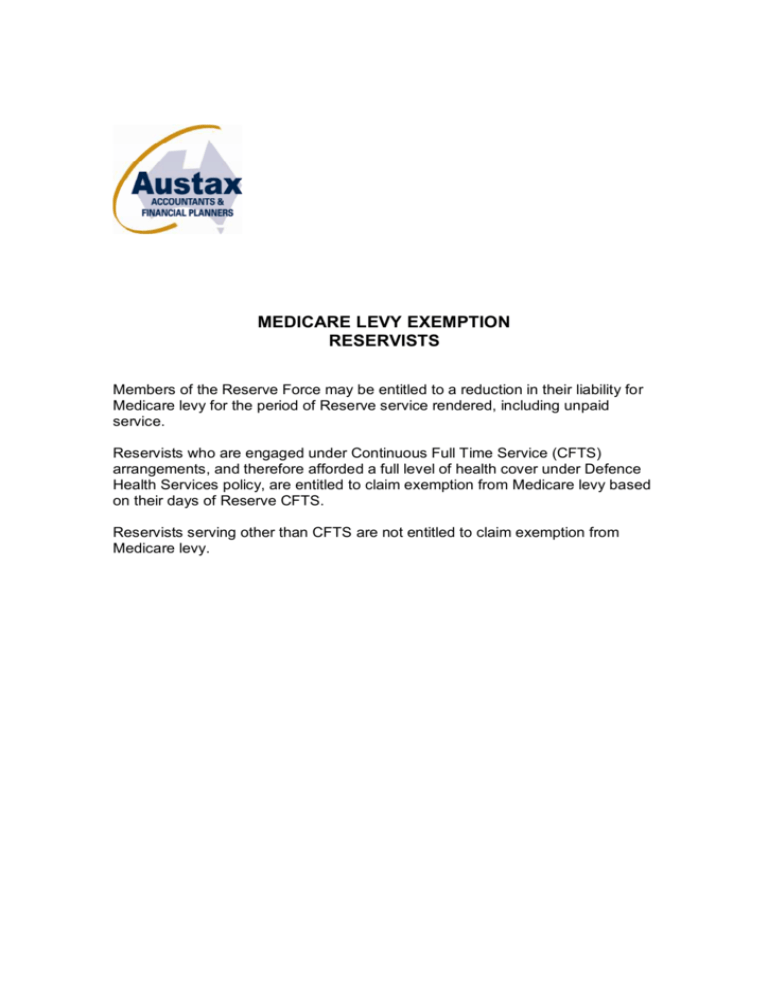

Medicare levy reduction. or exemption. Australian residents for tax purposes are subject to a Medicare levy of 1.5% of their taxable income unless they qualify for a reduction or exemption. If you were not an Australian resident for tax purposes for all of 2013 14, you are exempt from the Medicare levy.

Fillable Online Medicare Levy Exemption Form Fill Online, Printable, Fillable Fax Email

Medical exemption from Medicare levy When you can claim a full or half exemption from the Medicare levy. Last updated 29 June 2023 Print or Download On this page Conditions for medical exemption from Medicare levy Family agreement for Medicare levy exemption Conditions for medical exemption from Medicare levy

MEDICARE LEVY EXEMPTION RESERVISTS

Before we explain what is involved in the exemption process, lets look at the qualifying factors here - in order to be entitled to file for a Medicare levy exemption there are two key criteria: You must have earned in excess of $20, 542 in the financial year (as per the year end 30 th June 2014) You must be on a temporary visa in Australia.

Medicare levy reduction or exemption Medicare levy M1

Medicare is the scheme that gives Australian residents access to health care. To help fund the scheme, most taxpayers pay a Medicare levy of 2% of their taxable income. If your taxable income is equal to or less than your lower threshold amount ($22,398 in FY 2019), you do not have to pay the Medicare levy. You can claim a full exemption for.

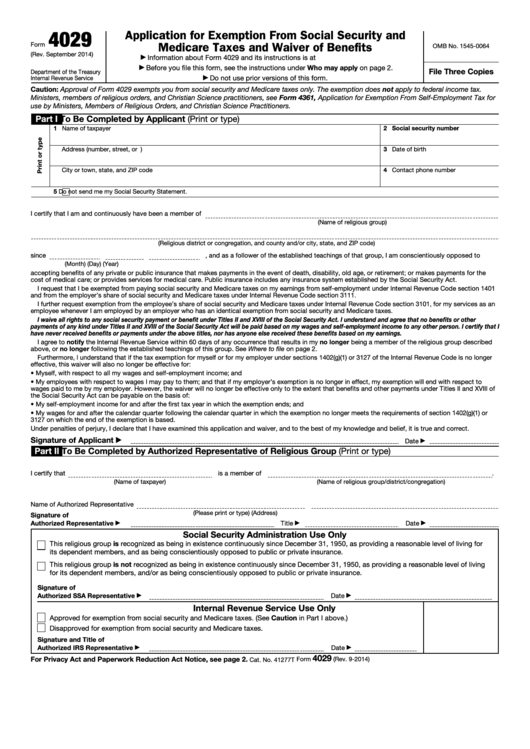

Fillable Form 4029 Application For Exemption From Social Security And Medicare Taxes And

How to apply for a Medicare levy exemption • You must get a new statement each year you claim a Medicare levy exemption. Just because you claimed the exemption before, does not mean you will get it every year. • We will process your application. It may take up to 6 weeks to process your application if you apply between July and November.

Home health care license Medicare levy exemption form 2019 pdf

If your spouse is not eligible for Medicare, you will both need a statement before you can start your tax return. Keep the statement for your records. The ATO will decide if you need to pay the Medicare levy. The MES is only one factor that the ATO takes into account when working out if you need to pay the Medicare levy.

Medicare levy exemption Instructions

To claim an exemption from the Medicare levy in your income tax return, you may be required to supply a copy of your Medicare levy exemption certification to the Australian Taxation Office (ATO) if requested. Eligibility You may be eligible for Medicare levy exemption if you: • do nothold an Australian permanent resident visa and have not

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

The Citrus Longhorned Beetle (CLB) Anoplophora chinensis (Förster) (= malasiaca) (Coleoptera, Cerambycidae), was first discovered in northern Italy in 2001 (Colombo & Limonta, 2001; Maspero et al. 2007), where it is considered a serious threat to urban environments, nurseries and natural ecosystems. Since this time the number of interceptions.

Tax Facts for International Students PreCent Services

If you need help completing this form call the Medicare Levy Exemption Certification Unit on 1300 300 271* or email your enquiry to [email protected]. Queries about deductions of the Medicare levy from salary or wages should be directed to the Australian Tax Office. Application for Medicare levy exemption certification.

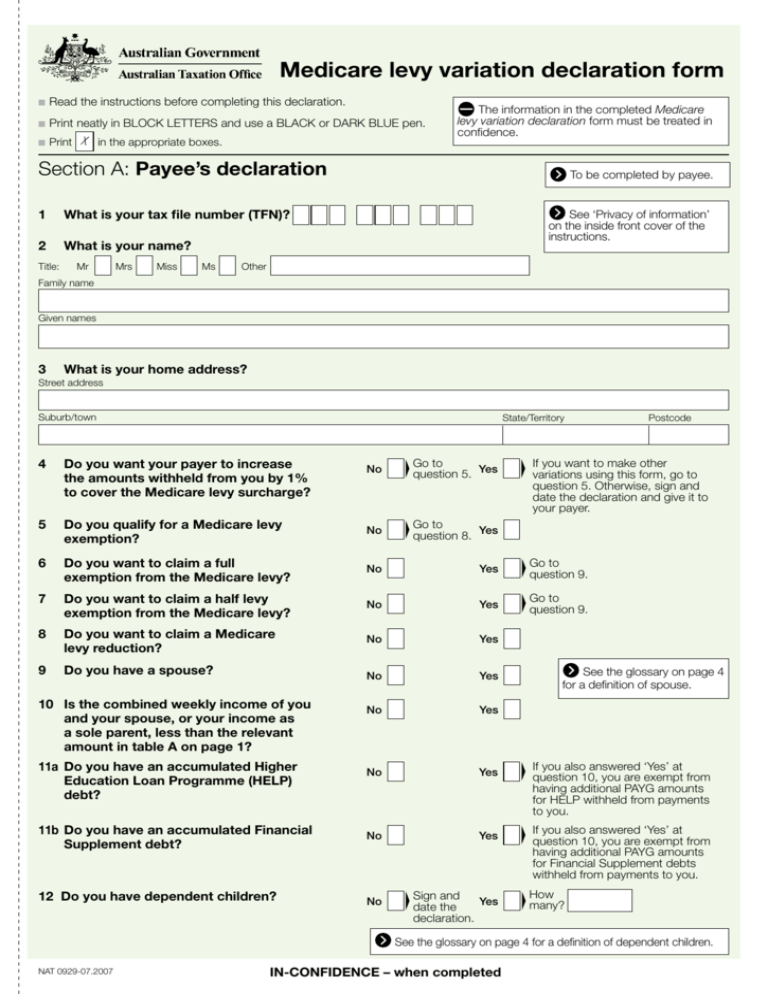

Medicare levy variation declaration

A Medicare levy exemption is based on specific categories. You need to consider your eligibility for a reduction or an exemption separately. Complete Part A to work out if you can claim the Medicare levy reduction. If you are not eligible for a reduction, complete Part B to work out if you can claim a Medicare levy exemption.

如何避免误交Medicare Levy?退税,您一定要知道的事!

You need a MES to apply for the Medicare levy exemption in your tax return. The Australian Taxation Office (ATO) will decide if you need to pay the Medicare levy. You must get a new MES each year you claim a Medicare levy exemption. Just because you claimed the exemption before, doesn't mean you'll get it every year.